Editor’s Note: The future prices of benchmark tracking ETFs were updated in the story.

U.S. stock futures fell on Thursday following Wednesday’s mixed close. Futures of major benchmark indices were lower.

The AI frenzy is still in full swing. Advanced Micro Devices Inc. (NASDAQ:AMD) surged over 11%, while Micron Technology Inc. (NASDAQ:MU) gained around 6% on Wednesday.

Meanwhile, the Fed minutes released on Wednesdays showed that President Donald Trump‘s trade tariffs continue to weigh on the outlook for growth and inflation, raising concerns over how long the Federal Reserve can stick with its planned cycle of interest rate cuts.

Additionally, Trump announced on Wednesday that both Israel and Hamas have agreed to the initial phase of a peace plan.

The 10-year Treasury bond yielded 4.13% and the two-year bond was at 3.59%. The CME Group’s FedWatch tool‘s projections show markets pricing a 94.6% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | -0.02% |

| S&P 500 | -0.07% |

| Nasdaq 100 | -0.13% |

| Russell 2000 | -0.32% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and the Nasdaq 100 index, respectively, fell in premarket on Tuesday. The SPY was down 0.0089% at $673.05, while the QQQ declined 0.047% to $611.15, according to Benzinga Pro data.

Stocks In Focus

PepsiCo

- PepsiCo Inc. (NASDAQ:PEP) was up 0.27% in premarket on Thursday, ahead of its earnings scheduled to be released before the opening bell. Analysts expect earnings of $2.26 per share on revenue of $23.83 billion.

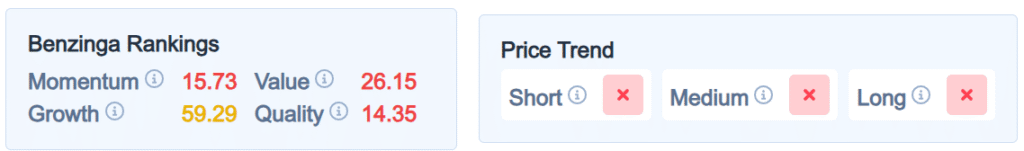

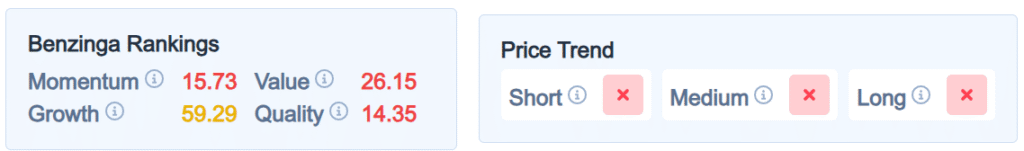

- PEP maintained a weaker price trend over the short, medium, and long terms, with a poor quality ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Turn Therapeutics

- Turn Therapeutics Inc. (NASDAQ:TTRX) surged …

Full story available on Benzinga.com

Editor’s Note: The future prices of benchmark tracking ETFs were updated in the story.

U.S. stock futures fell on Thursday following Wednesday’s mixed close. Futures of major benchmark indices were lower.

The AI frenzy is still in full swing. Advanced Micro Devices Inc. (NASDAQ:AMD) surged over 11%, while Micron Technology Inc. (NASDAQ:MU) gained around 6% on Wednesday.

Meanwhile, the Fed minutes released on Wednesdays showed that President Donald Trump‘s trade tariffs continue to weigh on the outlook for growth and inflation, raising concerns over how long the Federal Reserve can stick with its planned cycle of interest rate cuts.

Additionally, Trump announced on Wednesday that both Israel and Hamas have agreed to the initial phase of a peace plan.

The 10-year Treasury bond yielded 4.13% and the two-year bond was at 3.59%. The CME Group’s FedWatch tool‘s projections show markets pricing a 94.6% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | -0.02% |

| S&P 500 | -0.07% |

| Nasdaq 100 | -0.13% |

| Russell 2000 | -0.32% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and the Nasdaq 100 index, respectively, fell in premarket on Tuesday. The SPY was down 0.0089% at $673.05, while the QQQ declined 0.047% to $611.15, according to Benzinga Pro data.

Stocks In Focus

PepsiCo

- PepsiCo Inc. (NASDAQ:PEP) was up 0.27% in premarket on Thursday, ahead of its earnings scheduled to be released before the opening bell. Analysts expect earnings of $2.26 per share on revenue of $23.83 billion.

- PEP maintained a weaker price trend over the short, medium, and long terms, with a poor quality ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Turn Therapeutics

- Turn Therapeutics Inc. (NASDAQ:TTRX) surged …

Full story available on Benzinga.com

Editor’s Note: The future prices of benchmark tracking ETFs were updated in the story.

U.S. stock futures fell on Thursday following Wednesday’s mixed close. Futures of major benchmark indices were lower.

The AI frenzy is still in full swing. Advanced Micro Devices Inc. (NASDAQ:AMD) surged over 11%, while Micron Technology Inc. (NASDAQ:MU) gained around 6% on Wednesday.

Meanwhile, the Fed minutes released on Wednesdays showed that President Donald Trump‘s trade tariffs continue to weigh on the outlook for growth and inflation, raising concerns over how long the Federal Reserve can stick with its planned cycle of interest rate cuts.

Additionally, Trump announced on Wednesday that both Israel and Hamas have agreed to the initial phase of a peace plan.

The 10-year Treasury bond yielded 4.13% and the two-year bond was at 3.59%. The CME Group’s FedWatch tool‘s projections show markets pricing a 94.6% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

Futures

Change (+/-)

Dow Jones

-0.02%

S&P 500

-0.07%

Nasdaq 100

-0.13%

Russell 2000

-0.32%

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and the Nasdaq 100 index, respectively, fell in premarket on Tuesday. The SPY was down 0.0089% at $673.05, while the QQQ declined 0.047% to $611.15, according to Benzinga Pro data.

Stocks In Focus

PepsiCo

PepsiCo Inc. (NASDAQ:PEP) was up 0.27% in premarket on Thursday, ahead of its earnings scheduled to be released before the opening bell. Analysts expect earnings of $2.26 per share on revenue of $23.83 billion.

PEP maintained a weaker price trend over the short, medium, and long terms, with a poor quality ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Turn Therapeutics

Turn Therapeutics Inc. (NASDAQ:TTRX) surged …Full story available on Benzinga.com Read More$BTC, AMD, DAL, Earnings, Equities, Government, LEVI, Market Summary, MU, PEP, QQQ, Regulations, SPY, TTRX, YYAI, Futures, Commodities, Treasuries, Top Stories, Economics, Federal Reserve, Pre-Market Outlook, Markets, Trading Ideas, SPY, US78462F1030, AMD, US0079031078, DAL, US2473617023, MU, US5951121038, PEP, US7134481081, QQQ, US73935A1043, LEVI, $BTC, YYAI, TTRX, Earnings, Equities, Government, Regulations, Market Summary, Futures, Commodities, Treasuries, Top Stories, Economics, Federal Reserve, Pre-Market Outlook, Markets, Trading Ideas, Benzinga Markets