Editor’s Note: The future prices of benchmark tracking ETFs were updated in the story.

U.S. stock futures rose on Monday following Friday’s sell-off. Futures of major benchmark indices were higher.

Magnificent 7 stocks surged in premarket following President Donald Trump‘s de-escalation on Sunday, saying, “Don’t worry about China, it will all be fine,” adding that the “Highly respected President Xi just had a bad moment.”

Asian markets tumbled in trade on Monday, with major Chinese technology and auto stocks falling sharply in trade in Hong Kong.

The 10-year Treasury bond yielded 4.03% and the two-year bond was at 3.50%. The CME Group’s FedWatch tool‘s projections show markets pricing a 96.2% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.96% |

| S&P 500 | 1.33% |

| Nasdaq 100 | 1.84% |

| Russell 2000 | 1.61% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Monday. The SPY was up 1.14% at $660.47, while the QQQ advanced 1.71% to $599.59, according to Benzinga Pro data.

Stocks In Focus

Magnificent 7 Stocks

- Nvidia Corp. (NASDAQ:NVDA) advanced 3.57%, Tesla Inc. (NASDAQ:TSLA) was up 2.70%, Microsoft Corp. (NASDAQ:MSFT) gained 1.51%, Apple Inc. (NASDAQ:AAPL) was higher by 1.75%, whereas Amazon.com Inc. (NASDAQ:AMZN) rose by 2.09% and Alphabet Inc. (NASDAQ:GOOG) and Meta Platforms Inc. (NASDAQ:META) gained 1.52% and 1.56%, respectively.

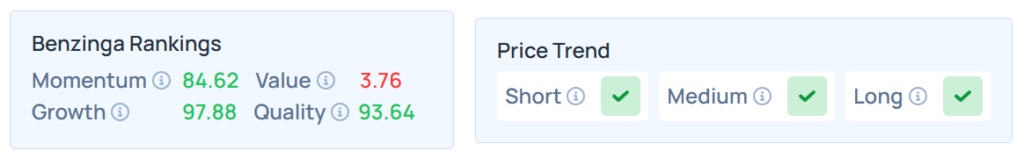

- NVDA maintained a stronger price trend over the short, medium, and long terms, with a poor value ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Fastenal

- Fastenal Co. (NASDAQ:FAST) jumped 2.57% ahead of its earnings before the opening bell. Analysts estimate earnings of 30 cents per share on revenue of $2.13 billion.

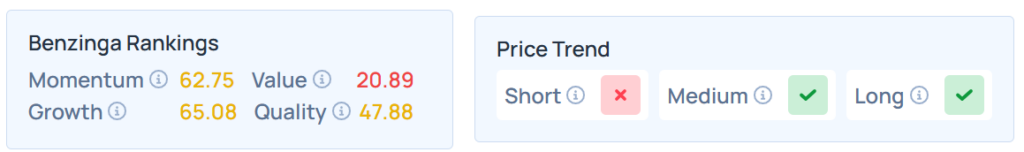

- Benzinga’s Edge Stock Rankings indicate that FAST had a weaker price trend in the short term but a strong trend in the medium and long terms, with a moderate quality ranking. Additional performance details are available here.

Editor’s Note: The future prices of benchmark tracking ETFs were updated in the story.

U.S. stock futures rose on Monday following Friday’s sell-off. Futures of major benchmark indices were higher.

Magnificent 7 stocks surged in premarket following President Donald Trump‘s de-escalation on Sunday, saying, “Don’t worry about China, it will all be fine,” adding that the “Highly respected President Xi just had a bad moment.”

Asian markets tumbled in trade on Monday, with major Chinese technology and auto stocks falling sharply in trade in Hong Kong.

The 10-year Treasury bond yielded 4.03% and the two-year bond was at 3.50%. The CME Group’s FedWatch tool‘s projections show markets pricing a 96.2% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.96% |

| S&P 500 | 1.33% |

| Nasdaq 100 | 1.84% |

| Russell 2000 | 1.61% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Monday. The SPY was up 1.14% at $660.47, while the QQQ advanced 1.71% to $599.59, according to Benzinga Pro data.

Stocks In Focus

Magnificent 7 Stocks

- Nvidia Corp. (NASDAQ:NVDA) advanced 3.57%, Tesla Inc. (NASDAQ:TSLA) was up 2.70%, Microsoft Corp. (NASDAQ:MSFT) gained 1.51%, Apple Inc. (NASDAQ:AAPL) was higher by 1.75%, whereas Amazon.com Inc. (NASDAQ:AMZN) rose by 2.09% and Alphabet Inc. (NASDAQ:GOOG) and Meta Platforms Inc. (NASDAQ:META) gained 1.52% and 1.56%, respectively.

- NVDA maintained a stronger price trend over the short, medium, and long terms, with a poor value ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Fastenal

- Fastenal Co. (NASDAQ:FAST) jumped 2.57% ahead of its earnings before the opening bell. Analysts estimate earnings of 30 cents per share on revenue of $2.13 billion.

- Benzinga’s Edge Stock Rankings indicate that FAST had a weaker price trend in the short term but a strong trend in the medium and long terms, with a moderate quality ranking. Additional performance details are available here.

Editor’s Note: The future prices of benchmark tracking ETFs were updated in the story.

U.S. stock futures rose on Monday following Friday’s sell-off. Futures of major benchmark indices were higher.

Magnificent 7 stocks surged in premarket following President Donald Trump‘s de-escalation on Sunday, saying, “Don’t worry about China, it will all be fine,” adding that the “Highly respected President Xi just had a bad moment.”

Asian markets tumbled in trade on Monday, with major Chinese technology and auto stocks falling sharply in trade in Hong Kong.

The 10-year Treasury bond yielded 4.03% and the two-year bond was at 3.50%. The CME Group’s FedWatch tool‘s projections show markets pricing a 96.2% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

Futures

Change (+/-)

Dow Jones

0.96%

S&P 500

1.33%

Nasdaq 100

1.84%

Russell 2000

1.61%

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Monday. The SPY was up 1.14% at $660.47, while the QQQ advanced 1.71% to $599.59, according to Benzinga Pro data.

Stocks In Focus

Magnificent 7 Stocks

Nvidia Corp. (NASDAQ:NVDA) advanced 3.57%, Tesla Inc. (NASDAQ:TSLA) was up 2.70%, Microsoft Corp. (NASDAQ:MSFT) gained 1.51%, Apple Inc. (NASDAQ:AAPL) was higher by 1.75%, whereas Amazon.com Inc. (NASDAQ:AMZN) rose by 2.09% and Alphabet Inc. (NASDAQ:GOOG) and Meta Platforms Inc. (NASDAQ:META) gained 1.52% and 1.56%, respectively.

NVDA maintained a stronger price trend over the short, medium, and long terms, with a poor value ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Fastenal

Fastenal Co. (NASDAQ:FAST) jumped 2.57% ahead of its earnings before the opening bell. Analysts estimate earnings of 30 cents per share on revenue of $2.13 billion.

Benzinga’s Edge Stock Rankings indicate that FAST had a weaker price trend in the short term but a strong trend in the medium and long terms, with a moderate quality ranking. Additional performance details are available here. Read More$BTC, AAPL, AMZN, Analyst Color, Asia, BABA, Cryptocurrency, Earnings, Earnings Beats, Earnings Misses, Equities, FAST, FFAI, GOOG, Government, JD, LCID, Macro Economic Events, Macro Notification, Market Summary, META, MSFT, News, NVDA, QQQ, Regulations, SPY, TSLA, VNCE, Bonds, Broad U.S. Equity ETFs, Guidance, Emerging Markets, Eurozone, Futures, Commodities, Forex, Treasuries, Econ #s, Top Stories, Economics, Federal Reserve, Pre-Market Outlook, Markets, ETFs, General, LCID, FFAI, SPY, US78462F1030, AAPL, US0378331005, AMZN, US0231351067, FAST, US3119001044, GOOG, US38259P7069, MSFT, US5949181045, NVDA, US67066G1040, TSLA, US88160R1014, QQQ, US73935A1043, BABA, VNCE, JD, META, $BTC, Government, News, Cryptocurrency, Analyst Color, Regulations, Asia, Macro Economic Events, Earnings, Earnings Beats, Earnings Misses, Market Summary, Macro Notification, Equities, Broad U.S. Equity ETFs, Bonds, Guidance, Emerging Markets, Eurozone, Futures, Commodities, Forex, Treasuries, Econ #s, Top Stories, Economics, Federal Reserve, Pre-Market Outlook, Markets, ETFs, General, Benzinga Markets