Editor’s Note: The future prices of benchmark tracking ETFs, the lede, and the latest economic releases were updated in the story.

U.S. stock futures declined on Tuesday following Monday’s reversal rally. Futures of major benchmark indices were lower.

Based on the latest NFIB report, small business optimism fell in September for the first time in three months, dropping 2.0 points to 98.8. The decline was largely driven by a sharp drop in owners’ expectations of better business conditions in the coming months. Compounding the issue, the Uncertainty Index surged 7 points to 100, the fourth-highest reading in over 51 years, as concerns over inflation, labor quality, and taxes continue to weigh on business owners.

Treasury Secretary Scott Bessent said that the ongoing government shutdown has started to affect the real economy and accused the mainstream media of “downplaying the shutdown” to “avoid embarrassing Democrats,” further exacerbating the public’s understanding of the situation’s severity.

Meanwhile, the 10-year Treasury bond yielded 4.01% and the two-year bond was at 3.47%. The CME Group’s FedWatch tool’s projections show markets pricing a 97.8% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | -0.41% |

| S&P 500 | -0.72% |

| Nasdaq 100 | -0.95% |

| Russell 2000 | -0.72% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Tuesday. The SPY was down 0.83% at $657.56 while the QQQ declined 1.09% to $595.45, according to Benzinga Pro data.

Stocks In Focus

Goldman Sachs Group

- Goldman Sachs Group Inc. (NYSE:GS) fell 0.61%, ahead of its earnings before the opening bell. Analysts estimate earnings of $11.00 per share on revenue of $14.10 billion.

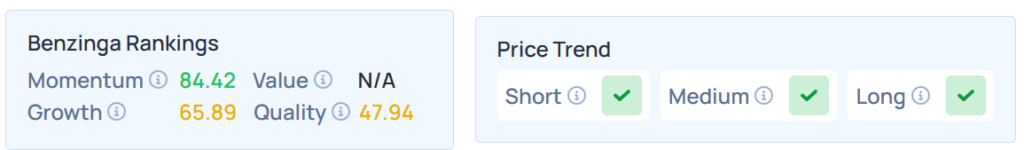

- GS maintained a stronger price trend over the short, medium, and long terms, with a moderate quality ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Full story available on Benzinga.com

Editor’s Note: The future prices of benchmark tracking ETFs, the lede, and the latest economic releases were updated in the story.

U.S. stock futures declined on Tuesday following Monday’s reversal rally. Futures of major benchmark indices were lower.

Based on the latest NFIB report, small business optimism fell in September for the first time in three months, dropping 2.0 points to 98.8. The decline was largely driven by a sharp drop in owners’ expectations of better business conditions in the coming months. Compounding the issue, the Uncertainty Index surged 7 points to 100, the fourth-highest reading in over 51 years, as concerns over inflation, labor quality, and taxes continue to weigh on business owners.

Treasury Secretary Scott Bessent said that the ongoing government shutdown has started to affect the real economy and accused the mainstream media of “downplaying the shutdown” to “avoid embarrassing Democrats,” further exacerbating the public’s understanding of the situation’s severity.

Meanwhile, the 10-year Treasury bond yielded 4.01% and the two-year bond was at 3.47%. The CME Group’s FedWatch tool’s projections show markets pricing a 97.8% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | -0.41% |

| S&P 500 | -0.72% |

| Nasdaq 100 | -0.95% |

| Russell 2000 | -0.72% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Tuesday. The SPY was down 0.83% at $657.56 while the QQQ declined 1.09% to $595.45, according to Benzinga Pro data.

Stocks In Focus

Goldman Sachs Group

- Goldman Sachs Group Inc. (NYSE:GS) fell 0.61%, ahead of its earnings before the opening bell. Analysts estimate earnings of $11.00 per share on revenue of $14.10 billion.

- GS maintained a stronger price trend over the short, medium, and long terms, with a moderate quality ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Full story available on Benzinga.com

Editor’s Note: The future prices of benchmark tracking ETFs, the lede, and the latest economic releases were updated in the story.

U.S. stock futures declined on Tuesday following Monday’s reversal rally. Futures of major benchmark indices were lower.

Based on the latest NFIB report, small business optimism fell in September for the first time in three months, dropping 2.0 points to 98.8. The decline was largely driven by a sharp drop in owners’ expectations of better business conditions in the coming months. Compounding the issue, the Uncertainty Index surged 7 points to 100, the fourth-highest reading in over 51 years, as concerns over inflation, labor quality, and taxes continue to weigh on business owners.

Treasury Secretary Scott Bessent said that the ongoing government shutdown has started to affect the real economy and accused the mainstream media of “downplaying the shutdown” to “avoid embarrassing Democrats,” further exacerbating the public’s understanding of the situation’s severity.

Meanwhile, the 10-year Treasury bond yielded 4.01% and the two-year bond was at 3.47%. The CME Group’s FedWatch tool’s projections show markets pricing a 97.8% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

Futures

Change (+/-)

Dow Jones

-0.41%

S&P 500

-0.72%

Nasdaq 100

-0.95%

Russell 2000

-0.72%

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Tuesday. The SPY was down 0.83% at $657.56 while the QQQ declined 1.09% to $595.45, according to Benzinga Pro data.

Stocks In Focus

Goldman Sachs Group

Goldman Sachs Group Inc. (NYSE:GS) fell 0.61%, ahead of its earnings before the opening bell. Analysts estimate earnings of $11.00 per share on revenue of $14.10 billion.

GS maintained a stronger price trend over the short, medium, and long terms, with a moderate quality ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Full story available on Benzinga.com Read More$BTC, Analyst Color, Asia, AVGO, Binary Options, C, Earnings, Earnings Beats, Earnings Misses, Equities, Government, GS, JNJ, JPM, Macro Economic Events, Macro Notification, Market Summary, News, NVDA, ORCL, PII, QQQ, Regulations, SPY, Bonds, Broad U.S. Equity ETFs, Guidance, Emerging Markets, Eurozone, Futures, Commodities, Forex, Treasuries, Global, Econ #s, Top Stories, Economics, Federal Reserve, Pre-Market Outlook, Markets, ETFs, General, SPY, US78462F1030, NVDA, US67066G1040, ORCL, US68389X1054, C, US1729674242, GS, US38141G1040, JNJ, US4781601046, JPM, US46625H1005, PII, US7310681025, AVGO, SG9999006241, QQQ, US73935A1043, $BTC, Macro Notification, Equities, Government, News, Analyst Color, Binary Options, Regulations, Earnings, Asia, Macro Economic Events, Earnings Beats, Earnings Misses, Market Summary, Broad U.S. Equity ETFs, Bonds, Guidance, Emerging Markets, Eurozone, Futures, Commodities, Forex, Treasuries, Global, Econ #s, Top Stories, Economics, Federal Reserve, Pre-Market Outlook, Markets, ETFs, General, Benzinga Markets