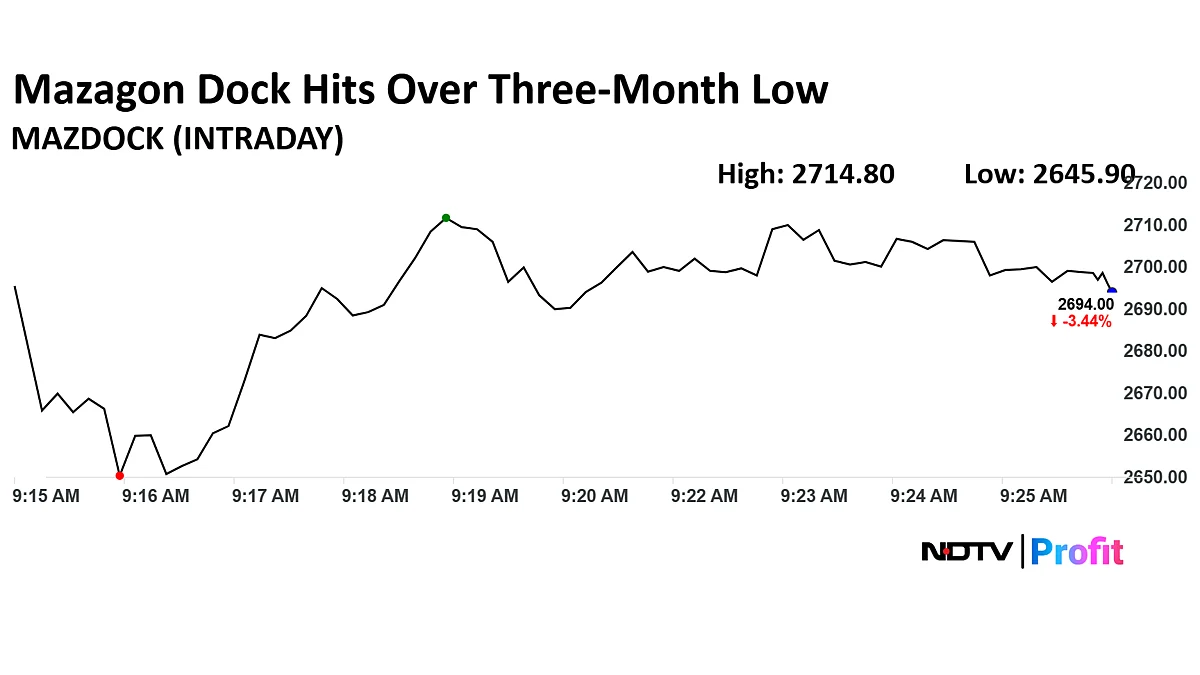

Stock Market Today: Mazagon Dock Share Price Hits Over Three-Month Low

Mazagon Dock Shipbuilders Ltd. share price slumped 5.16% to Rs 2,645.90 apiece, the lowest level since April 25. It was trading 4.08% down at Rs 2,676.10 apiece as of 9:28 a.m., as compared to 0.01% advance in the NSE Nifty 50 index.

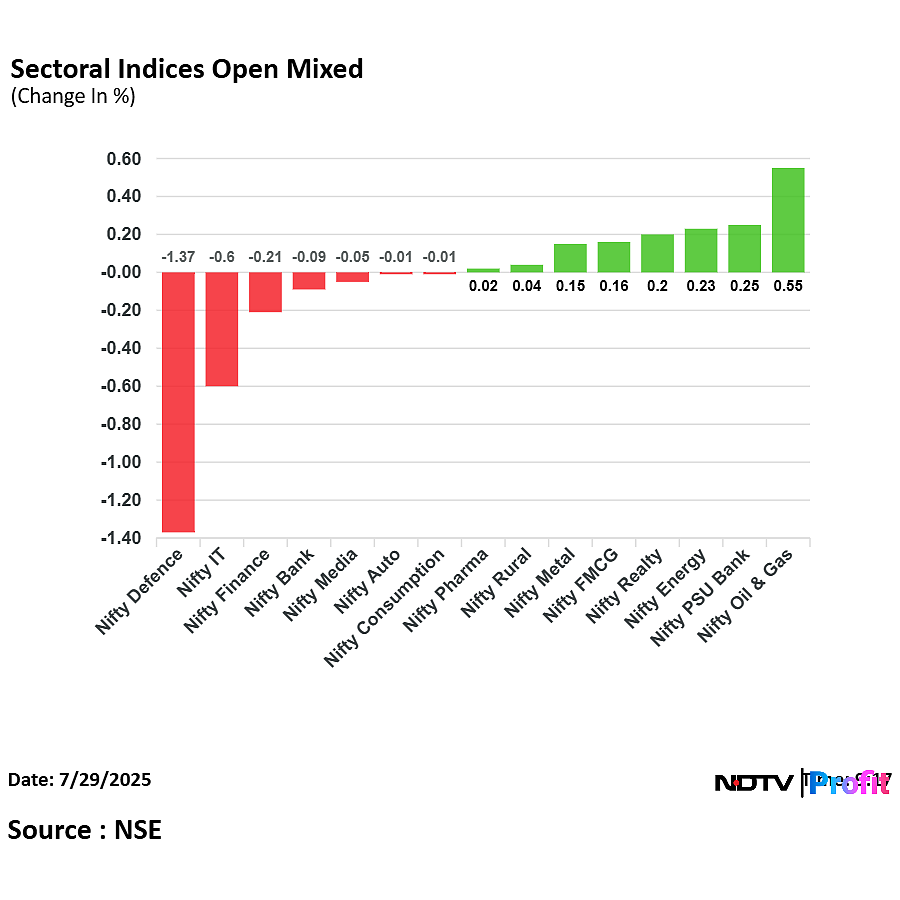

Sectoral Performance At Open: Nifty Defence Underperforms

On National Stock Exchange Ltd., five sectoral indices declined, six advanced, and four remained flat out of 15. The NSE Nifty Defence declined the most, and the NSE Nifty Oil & Gas rose the most.

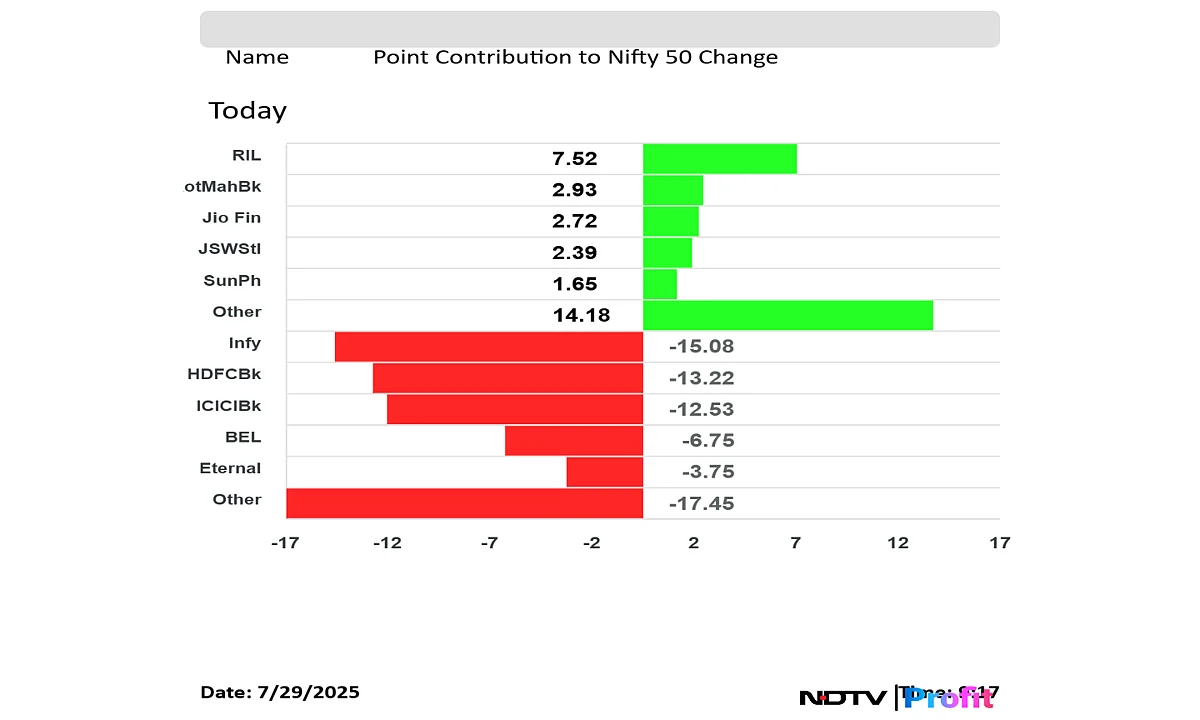

Nifty Detractors: Infosys, HDFC Bank Weigh Most

Infosys Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Bharat Electronics Ltd., and Eternal Ltd. weighed on the Nifty 50 index.

Reliance Industries Ltd., Kotak Mahindra Bank Ltd., Jio Financial Services Ltd., JSW Steel Ltd., and Sun Pharmaceutical Industries Ltd. added to the Nifty 50 index.

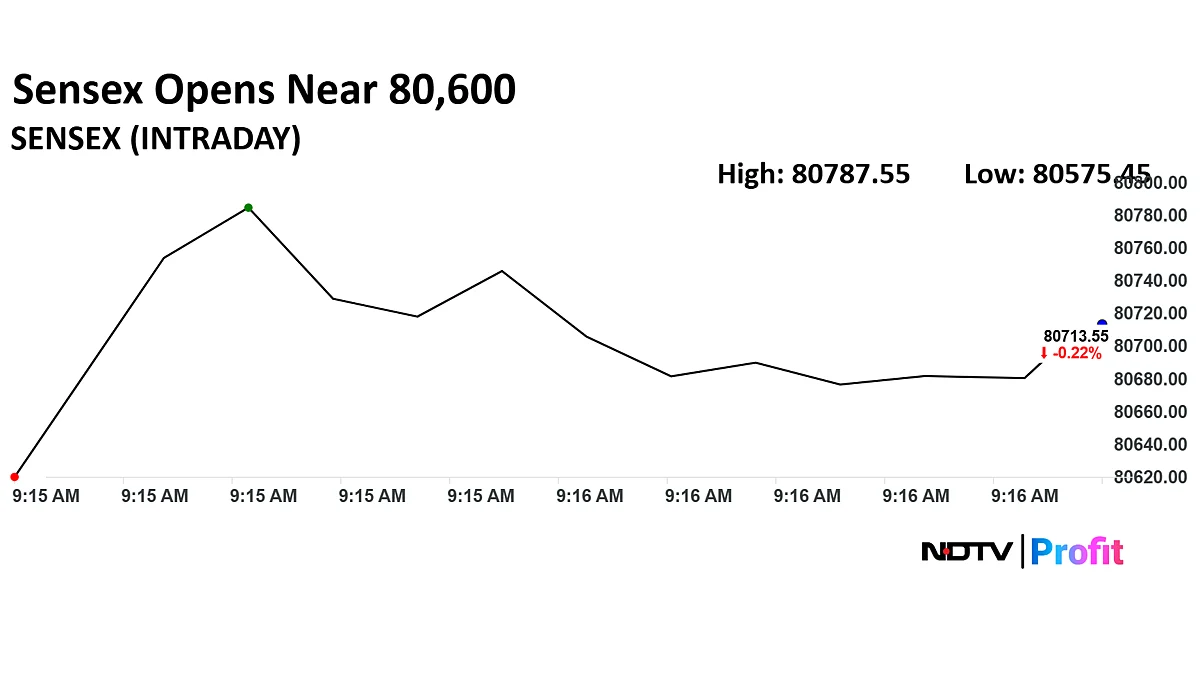

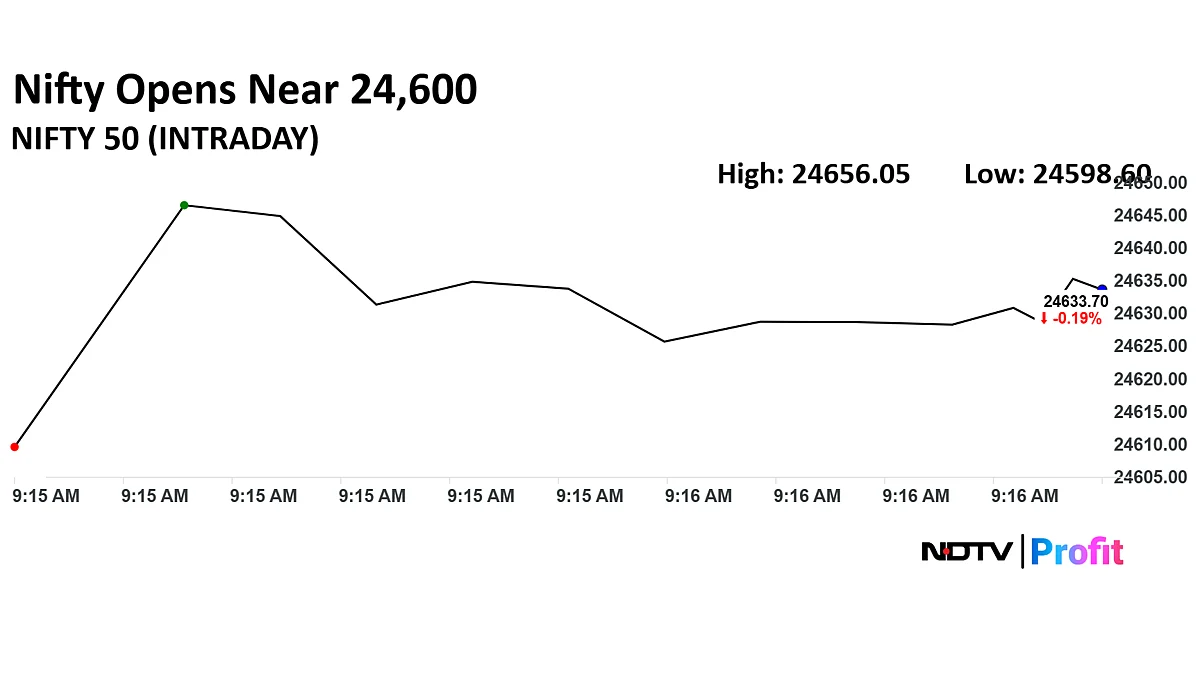

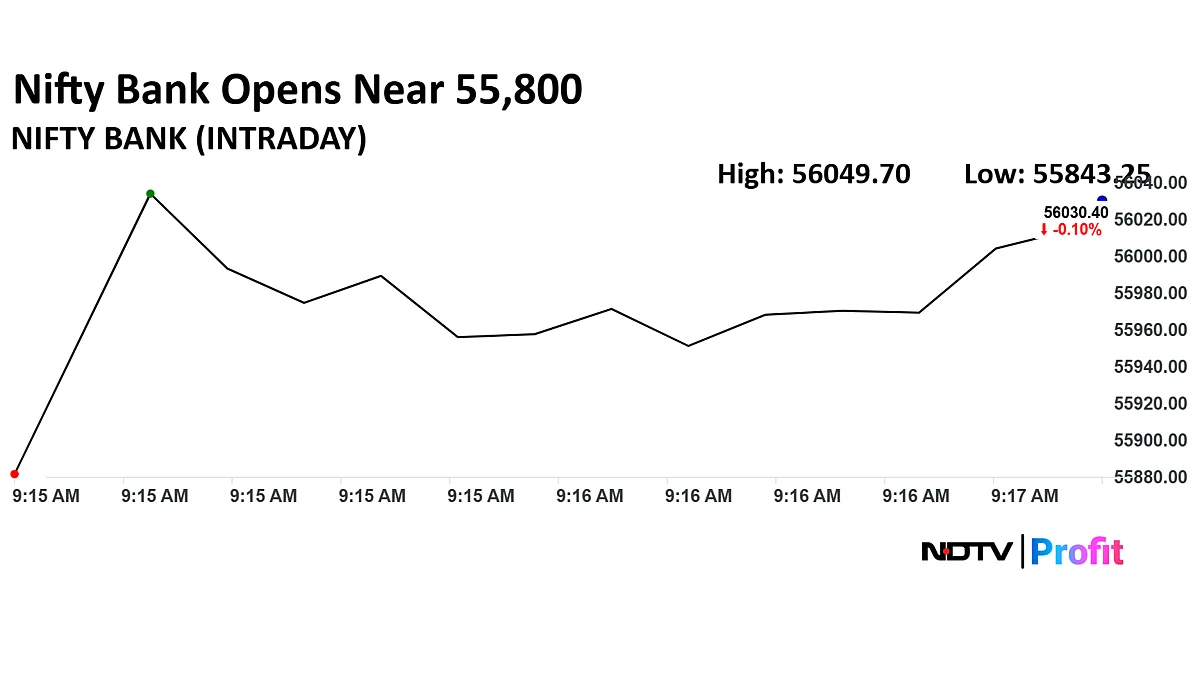

Stock Market Open: Nifty, Sensex Extend Losses As ICICI Bank Drags

The NSE Nifty 50 and BSE Sensex extended losses to a fourth day as ICICI Bank and Infosys Ltd. shares dragged. The indices were trading 0.07% and 0.14% down, respectively as of 9:21 a.m.

Radico Khaitan Rated New ‘Buy’ At CLSA — 16% Upside Seen

CLSA has initiated coverage on Radico Khaitan, one of India’s leading spirits manufacturers, with an ‘Outperform’ rating and a target price of Rs 3,098, implying a potential upside of 16% from current levels. The firm sees Radico as a robust long-term premiumisation play in India’s evolving alcoholic beverages market.

“Radico Khaitan is the leading manufacturer of white spirits (vodka, gin etc) in India and is building a portfolio of premium and luxury brands across the spirits categories,” CLSA said in its initiation note.

Yield On The 10-Year Bond Opens Flat

-

The 10-year bond yield opened flat at 6.38%

Source: Bloomberg

Rupee Opens Weaker Against US Dollar

-

Rupee opened 16 paise weaker at 86.83 against US Dollar

-

It’s the lowest level since June 19

-

It closed at 86.67 a dollar on Friday

Source: Cogencis

Varun Beverages, NTPC, Asian Paints, L&T Among 100 Companies To Declare Earnings On July 29

At least 100 companies are set to report their Q1FY26 financial results on July 29. These earnings will reflect the financial performance of these companies for the April-June period. It will be their first quarterly update for FY2025-26.

Some of the prominent names include NTPC, Asian Paints, Bank of India, Blue Dart Express, among companies spread across different sectors. In the upcoming results, investors and analysts will focus on key financial metrics, including revenue, profit, and margins. These figures will offer insights into consumption trends, sectoral performance and overall economic health of India.

Jane Street To Argue That Retail Demand Drove Its India Trades

Jane Street Group LLC is expected to argue that its controversial Indian options trades were a response to outsized demand from retail investors, people familiar with the matter said.

The trading giant has been working on its defense against market manipulation allegations from the Securities and Exchange Board of India. The regulator in early July alleged Jane Street had taken large positions that artificially influenced prices in the country’s stock and futures markets, moving them in favor of its options bets on multiple days.

Stock Market Live Update: Deepak Fertilisers’ Arm To Raise Gopalpur TAN Project Cost To Rs 2,675 Crore

Deepak Fertilisers’ subsidiary has revised the cost of its Gopalpur Technical Ammonium Nitrate (TAN) project to Rs 2,675 crore, up from the earlier estimate of Rs 2,223 crore. The increase is attributed to geopolitical challenges and consequent rises in material and other input costs.

IEX Shares Downgraded At Bernstein Over CERC’s Market Coupling Move, 29% Downside Seen

Bernstein has downgraded Indian Energy Exchange (IEX) to Underperform and set a target price of Rs 99 per share, implying a 29% downside from Monday’s close. The brokerage cited regulatory risks from market coupling as more severe than previously anticipated.

Bharat Electronics Q1 Review: Analysts Cheer Strong Order Book

Bharat Electronics Ltd.’s expansion in operating margin in the first quarter of the current fiscal and a strong order book have kept analysts bullish on the stock.

JPMorgan said the muted revenue growth, which missed estimates, is not a concern, as it is primarily impacted by fluctuations in product delivery rather than underlying business performance.

Stock Market Today: Brokerages On IndusInd Bank

Citi Research On IndusInd Bank

-

Maintain Sell with a target price of Rs 765

-

Earnings Reset in Progress; Eyes on CEO Appointment

-

Slippages normalized after one-offs in 1Q, though remains elevated

-

See weaker growth and higher credit cost, partially offset by better NIM and treasury gains

-

Cut earnings lower by 2-3% for FY26E/FY27E

-

Upcoming trigger will be CEO announcement and strategic roadmap under new leadership

Morgan Stanley On IndusInd Bank

-

Maintain Underweight with a target price of Rs 750

-

Q1: NII beat; Fee income miss

-

Core PPoP, excluding IT refund and others, was 11% below estimates

-

Slippages remained high at 3% of loans, as did credit costs

-

Have reduced earnings by 15-20% in FY26-28

-

Expect FY26 to be very weak with RoA of 0.6%, with a gradual recovery in FY27/FY28 to 0.8%/1%

Oil Prices Rise For Second Day As US Asks Russia To End Hostility In Ukraine

Oil prices extended gain to a second day after US President Donald Trump warned of a secondary sanction in case Moscow does not end hostility inside Ukraine. Trump would likely impose a 10–12 days of deadline.

The Brent crude’s October future contract was trading 0.30% down at $69.36 a barrel.

Asia Market Update: Nikkei 225, KOSPI Trade Lower

Markets across Japan, South Korea, and Australia were trading lower as market participants await more details on US and China trade negotiations. Further, they also await the outcome of the US Federal Reserve’s policy meeting, scheduled for release on Wednesday.

The Nikkei 225 and TOPIX were trading 0.81% and 0.82% down, respectively as of 7:00 a.m. The KOSPI and S&P ASX 200 were trading 0.06% and 0.23% down, respectively.

US Market Update: S&P 500 And Nasdaq 100 Futures Advance On Trade Optimism

Most US futures were trading higher in Asia session as trade optimism continued to fuel risk-on sentiment. The S&P 500 and Nasdaq 100 futures were trading 0.07% and 0.21% higher, respectively as of 6:55 a.m.

GIFT Nifty Implies Tepid Open; GAIL, IndusInd Bank, Mazagon Dock, NTPC Green In Focus

The GIFT Nifty was trading 0.04% or 10 points higher at 24,660 as of 6:32 a.m., which implied a tepid start for the benchmark index.

Gail (India) Ltd., IndusInd Bank Ltd., Mazagon Dock Shipbuilders Ltd., and NTPC Green Energy Ltd. shares were in focus because of the first-quarter earnings.

India’s benchmark equity indices extended their decline to the third day as weak first-quarter results from Kotak Mahindra Bank Ltd. weighed the most.

The NSE Nifty 50 settled 156.1 points or 0.63% lower at 24,680.9, while the BSE Sensex shed 572.07 points or 0.7% to close at 80,891.02.

. Read more on Markets by NDTV Profit.Defence stocks were biggest laggard on National Stock Exchange. Read MoreMarkets, Notifications

NDTV Profit