Japanese shares and the yen fell amid a brewing political crisis in the country, even as renewed optimism over US-China trade talks lifted sentiment across global markets. Futures indicated further gains for US stocks.

The Nikkei 225 index dropped 0.7% as traders reacted to the collapse of the nation’s ruling coalition and the US-China spat after a three-day weekend. Contracts for Hong Kong were flat while Australian shares edged lower. Silver prices touched an all-time high above $52.50 and gold set a new peak, building on eight straight weeks of gains. Samsung Electronics Co. rose after posting its biggest profit since 2022.

The S&P 500 clawed back some of Friday’s slump when fresh tensions between Washington and Beijing spooked investors. The gains signaled investors’ willingness to buy the dip as a resilient economy and Federal Reserve easing overshadowed concerns about a bubble in AI stocks. That optimism faces an early test this week, with a wave of earnings from major US banks marking the unofficial start of third-quarter results on Tuesday.

“Investors remain eager for exposure, and if this recovery holds, it will reinforce the idea that retail investors can’t be easily shaken and another reminder that buying the dip continues to work,” said Mark Hackett at Nationwide.

The artificial intelligence theme continued to dominate markets as Broadcom Inc. soared about 10% as OpenAI agreed to buy its custom chips and networking equipment. The Nasdaq 100 rose 2.2% Monday and a key gauge of chipmakers surged nearly 5%.

Shares of companies discussing alliances with Nvidia Corp. on Monday jumped, with Vertiv Holdings Co. closing at an all-time high and Navitas Semiconductor Corp. adding 31% after the bell following a 21% climb during the regular session.

Nvidia also struck a deal with Hon Hai Technology Group.

US-listed rare earth and critical mineral stocks jumped Monday, following strong gains among Asian peers, as fresh tensions between Beijing and Washington over China’s exports fueled bets on alternative suppliers.

Cryptocurrencies stabilized, recovering from the selloff on Friday. While the crash was brief and prices have since partially recovered, critics point to underlying issues in the crypto market’s structure that make it prone to violent selloffs.

Read More: Goldman, Citi Fueled by Record Trading: US Earnings Week Ahead

Meanwhile, US Treasury Secretary Scott Bessent said he still expects Presidents Donald Trump and Xi Jinping will meet.

However, he warned that all options are open for retaliating against China’s move to tighten exports of rare earths. China’s Ministry of Commerce had urged further negotiations to resolve outstanding issues.

The focus in Asia is on Japan following the collapse of the nation’s ruling coalition.

Equities investors who drove the Nikkei 225 and Topix stock gauges to fresh record highs last week are now assessing the fallout from the ruling Liberal Democratic Party’s loss of its coalition partner, Komeito, less than a week after Sanae Takaichi took over as leader of the LDP.

Stocks

-

S&P 500 futures rose 0.3% as of 9:39 a.m. Tokyo time

-

Hang Seng futures were little changed

-

Japan’s Topix fell 0.8%

-

Australia’s S&P/ASX 200 was little changed

-

Euro Stoxx 50 futures rose 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.1% to $1.1557

-

The Japanese yen fell 0.2% to 152.57 per dollar

-

The offshore yuan was little changed at 7.1381 per dollar

Cryptocurrencies

-

Bitcoin fell 0.4% to $115,353.01

-

Ether fell 0.9% to $4,253.83

Bonds

-

The yield on 10-year Treasuries advanced three basis points to 4.06%

-

Japan’s 10-year yield was unchanged at 1.690%

-

Australia’s 10-year yield was little changed at 4.30%

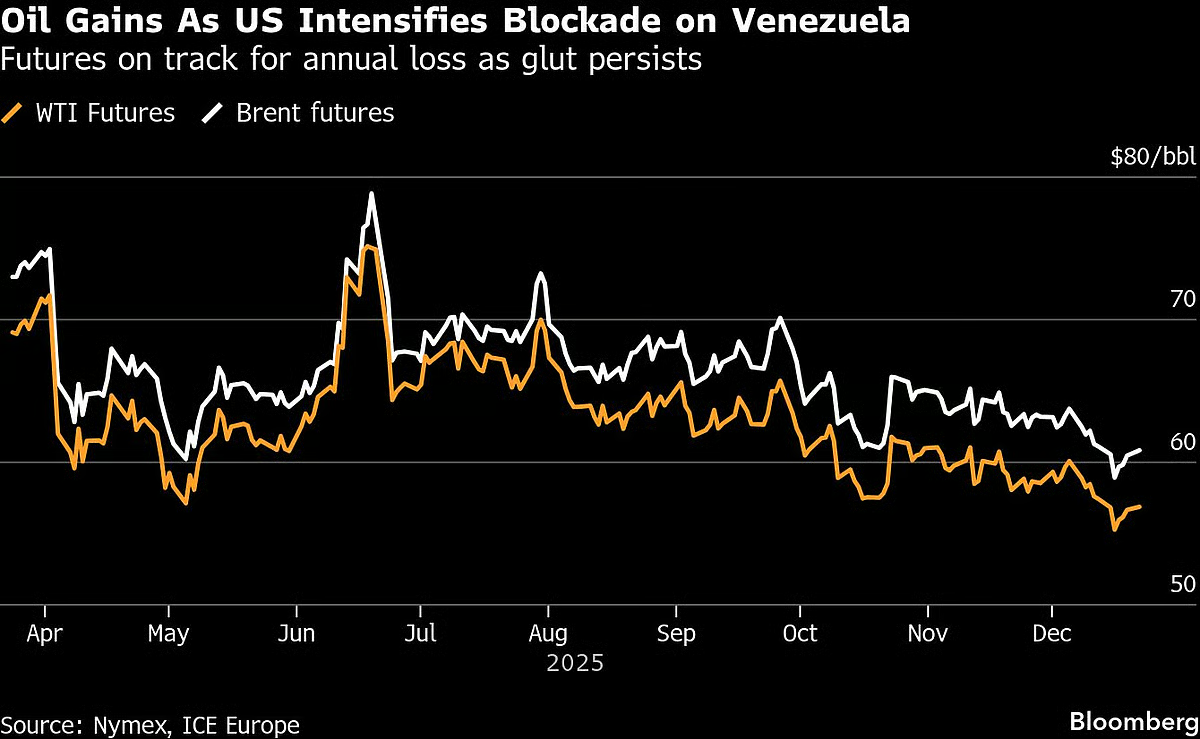

Commodities

-

West Texas Intermediate crude rose 0.4% to $59.75 a barrel

-

Spot gold rose 0.4% to $4,128.14 an ounce

. Read more on Markets by NDTV Profit.The Nikkei 225 index dropped 0.7%, contracts for Hong Kong were flat while Australian shares edged lower. Read MoreMarkets, Business, Bloomberg NDTV Profit