As U.S. Treasuries wobble under the weight of budget deficits and rate uncertainty, emerging market debt is quietly staging a comeback — offering higher real yields, currency resilience, and inflation breathing room.

Investors accustomed to reflexively retreating to Treasuries in times of volatility are reconsidering. The iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) is down over 8% over the past year, and still negative year-to-date.

In contrast, EM debt ETFs are showing strength: the iShares JP Morgan EM Local Currency Bond ETF (NYSE:LEMB) is up nearly 10% year-to-date, while the VanEck JP Morgan EM Local Currency Bond ETF (NYSE:EMLC) and the SPDR Bloomberg Emerging Markets Local Bond ETF (NYSE:EBND) have returned over 7%.

Even more compelling? These gains come as local inflation trends across emerging markets soften, not heating up.

Read Also: Vanguard Slashes Fees Across European Fixed Income UCITS ETFs, Enhancing Low-Cost Investing Options

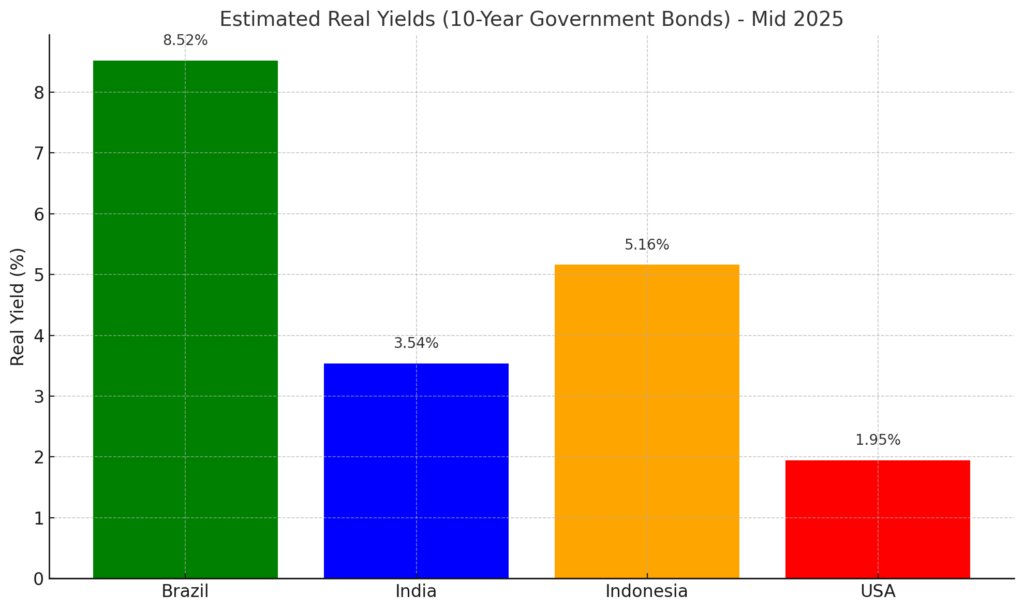

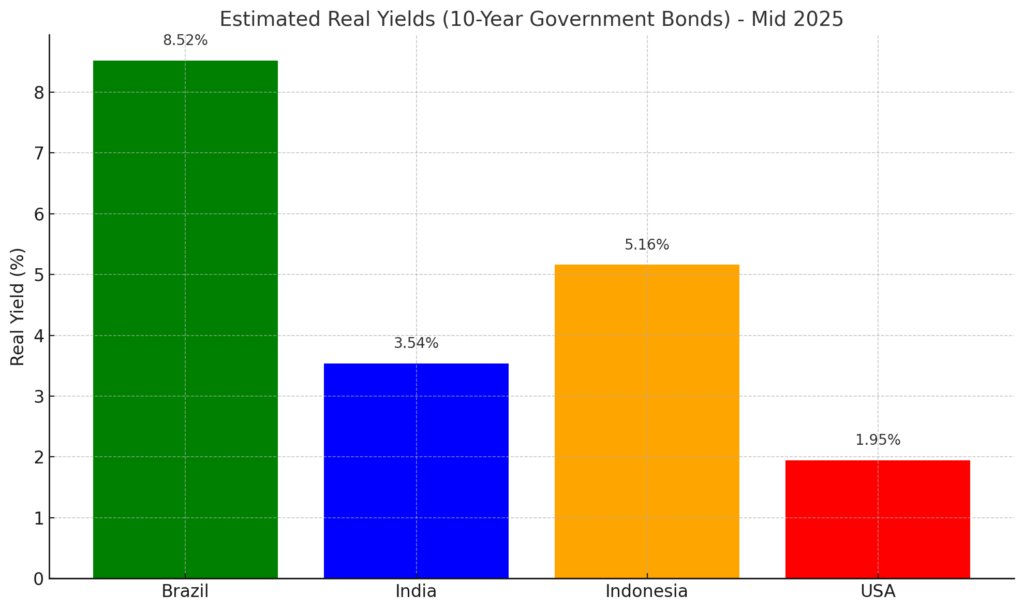

Real Yield Advantage Is Back

Full story available on Benzinga.com

As U.S. Treasuries wobble under the weight of budget deficits and rate uncertainty, emerging market debt is quietly staging a comeback — offering higher real yields, currency resilience, and inflation breathing room.

Investors accustomed to reflexively retreating to Treasuries in times of volatility are reconsidering. The iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) is down over 8% over the past year, and still negative year-to-date.

In contrast, EM debt ETFs are showing strength: the iShares JP Morgan EM Local Currency Bond ETF (NYSE:LEMB) is up nearly 10% year-to-date, while the VanEck JP Morgan EM Local Currency Bond ETF (NYSE:EMLC) and the SPDR Bloomberg Emerging Markets Local Bond ETF (NYSE:EBND) have returned over 7%.

Even more compelling? These gains come as local inflation trends across emerging markets soften, not heating up.

Read Also: Vanguard Slashes Fees Across European Fixed Income UCITS ETFs, Enhancing Low-Cost Investing Options

Real Yield Advantage Is Back

Full story available on Benzinga.com

As U.S. Treasuries wobble under the weight of budget deficits and rate uncertainty, emerging market debt is quietly staging a comeback — offering higher real yields, currency resilience, and inflation breathing room.

Investors accustomed to reflexively retreating to Treasuries in times of volatility are reconsidering. The iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) is down over 8% over the past year, and still negative year-to-date.

In contrast, EM debt ETFs are showing strength: the iShares JP Morgan EM Local Currency Bond ETF (NYSE:LEMB) is up nearly 10% year-to-date, while the VanEck JP Morgan EM Local Currency Bond ETF (NYSE:EMLC) and the SPDR Bloomberg Emerging Markets Local Bond ETF (NYSE:EBND) have returned over 7%.

Even more compelling? These gains come as local inflation trends across emerging markets soften, not heating up.

Read Also: Vanguard Slashes Fees Across European Fixed Income UCITS ETFs, Enhancing Low-Cost Investing Options

Real Yield Advantage Is Back

Full story available on Benzinga.com Read MoreEBND, EMLC, LEMB, Stories That Matter, TLT, Bonds, Emerging Markets, Top Stories, Markets, TLT, US4642874329, EMLC, US57060U5222, LEMB, EBND, Bonds, Emerging Markets, Top Stories, Markets, Benzinga Markets