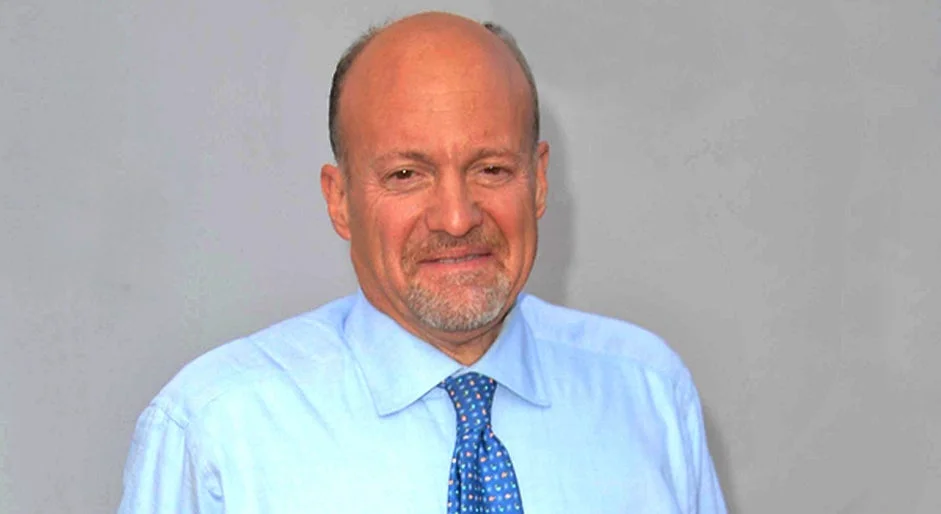

Jim Cramer believes that a consistent flow of trade agreements is crucial to bolstering market confidence and allaying fears of both recession and a surge in inflation.

What Happened: In a recent post on X, Cramer asserted that a “steady drip of trade deals” might be the key ingredient to sustain the current market momentum, particularly given the limited number of institutional investors holding bullish positions.

Cramer’s commentary underscores the market’s sensitivity to global trade dynamics and their potential impact on economic stability and price levels. The implication is that positive developments on the trade front could provide the necessary reassurance for investors, outweighing prevailing concerns about a potential economic downturn and escalating inflation.

In a subsequent post, Cramer also took aim …

Full story available on Benzinga.com

Jim Cramer believes that a consistent flow of trade agreements is crucial to bolstering market confidence and allaying fears of both recession and a surge in inflation.

What Happened: In a recent post on X, Cramer asserted that a “steady drip of trade deals” might be the key ingredient to sustain the current market momentum, particularly given the limited number of institutional investors holding bullish positions.

Cramer’s commentary underscores the market’s sensitivity to global trade dynamics and their potential impact on economic stability and price levels. The implication is that positive developments on the trade front could provide the necessary reassurance for investors, outweighing prevailing concerns about a potential economic downturn and escalating inflation.

In a subsequent post, Cramer also took aim …

Full story available on Benzinga.com

Jim Cramer believes that a consistent flow of trade agreements is crucial to bolstering market confidence and allaying fears of both recession and a surge in inflation.

What Happened: In a recent post on X, Cramer asserted that a “steady drip of trade deals” might be the key ingredient to sustain the current market momentum, particularly given the limited number of institutional investors holding bullish positions.

Cramer’s commentary underscores the market’s sensitivity to global trade dynamics and their potential impact on economic stability and price levels. The implication is that positive developments on the trade front could provide the necessary reassurance for investors, outweighing prevailing concerns about a potential economic downturn and escalating inflation.

Bulls, right now, want nothing but a steady drip of trade deals that will make people more confident that we won’t have a recession and inflation won’t spike. That might just be enough to keep things going given how few institutional bulls there are

— Jim Cramer (@jimcramer) May 13, 2025

In a subsequent post, Cramer also took aim …Full story available on Benzinga.com Read MoreAnalyst Color, bearish, Billionaire, Bull, China, Economy, Equities, Government, Inflation, John Murillo, Macro Economic Events, Macro Notification, Market Summary, News, QQQ, Recession, Regulations, SPY, Tariff, tariffs, Trade, trade deals, Broad U.S. Equity ETFs, Jim Cramer, Futures, Economics, Markets, Analyst Ratings, ETFs, General, SPY, US78462F1030, QQQ, US73935A1043, Macro Notification, News, Analyst Color, Equities, Government, Regulations, Macro Economic Events, Market Summary, Broad U.S. Equity ETFs, Futures, Economics, Markets, Analyst Ratings, ETFs, General, Benzinga Markets